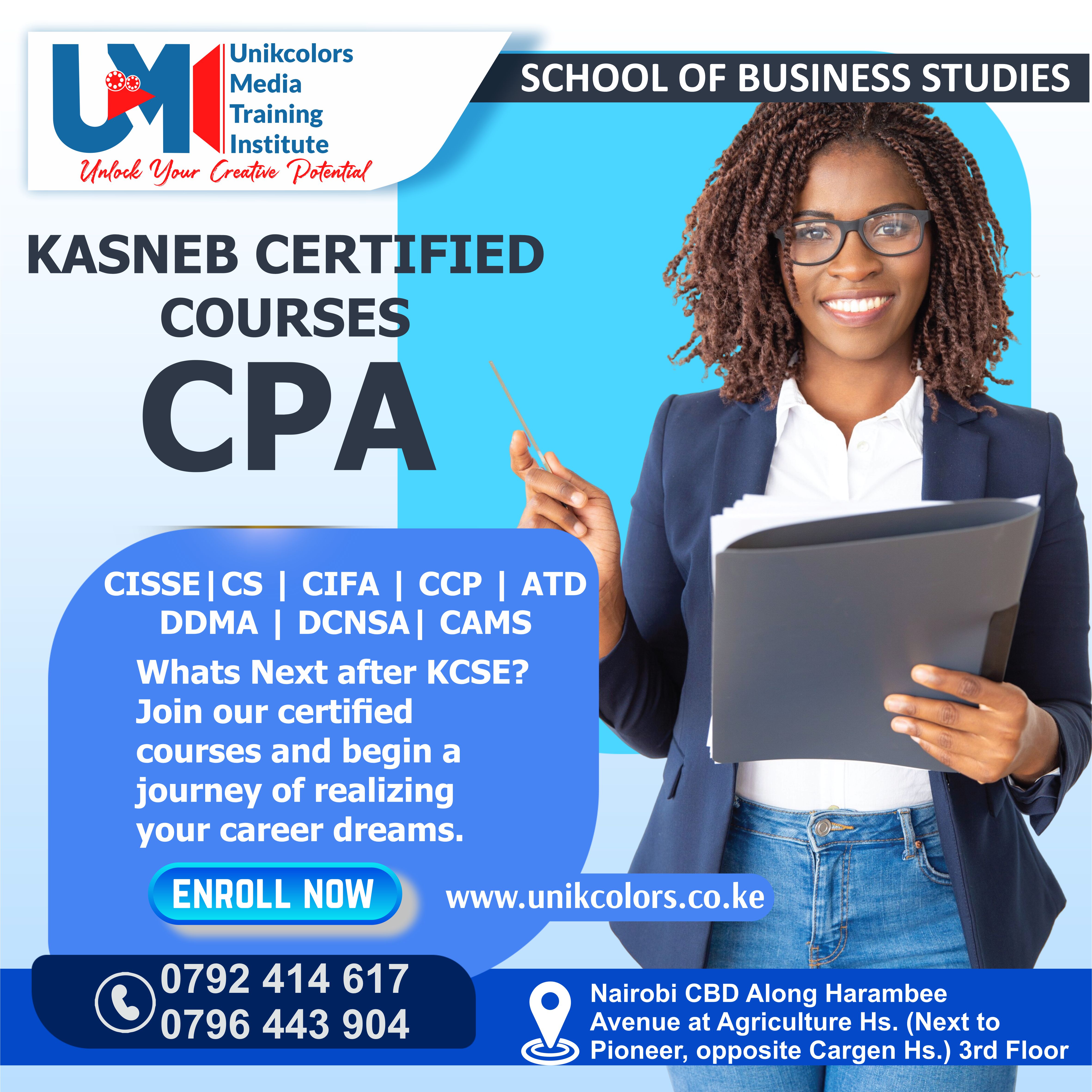

KASNEB CERTIFIED COURSES - CPA | CISSE | CS | CIFA | CCP | DDMA | DCNSA | CAMS

Title: KASNEB CERTIFIED COURSES - CPA | CISSE | CS | CIFA | CCP | DDMA | DCNSA | CAMS

Top 7 Accountancy Job Roles

Accountancy is a dynamic and rapidly growing field with a wide range of job opportunities. The demand for accountants is expected to continue to rise in 2025, as businesses look to ensure their financial systems and processes are in good order. In this article, we'll explore the top seven accountancy job roles of 2025.

Financial Accountant

Financial accountants are responsible for maintaining accurate and up-to-date financial records, including balance sheets, income statements, and cash flow statements. They ensure that these records comply with accounting standards and regulations, and they prepare reports and financial statements that provide a clear picture of an organization's financial health. Financial accountants also play an important role in tax preparation, budgeting, and financial analysis.

Management Accountant

Management accountants are strategic financial advisors who support executives and managers in making informed decisions about the direction and growth of the organization. They analyze financial data and provide insights into trends, risks, and opportunities. Management accountants also help create and monitor budgets, track expenses, and prepare financial reports and forecasts. They use their expertise to help organizations make informed decisions about resource allocation, pricing, and other financial matters.

Auditors

Auditors are responsible for reviewing financial records and systems to ensure that they are accurate, compliant with accounting standards, and free from fraud or abuse. They perform a wide range of tasks, including reviewing financial statements, evaluating internal controls, and testing the accuracy of financial data. Auditors provide recommendations for improving financial systems and processes, and they help organizations to reduce the risk of financial fraud and mismanagement.

Tax Accountants

Tax accountants are experts in tax law and regulations, and they provide tax planning and compliance services to individuals, businesses, and organizations. They prepare and file tax returns, and they provide advice on tax planning strategies, including tax credits and deductions, tax liability, and tax planning for business transactions. Tax accountants also stay up-to-date with changes in tax laws and regulations, and they help their clients to stay compliant with tax requirements.

Bookkeepers

Bookkeepers are responsible for maintaining accurate and up-to-date financial records, including invoices, receipts, and other financial transactions. They perform tasks such as reconciling accounts, preparing financial statements and handling payroll and other financial tasks. Bookkeepers must have strong attention to detail and a good understanding of financial processes and systems, and they play a crucial role in ensuring that an organization's financial records are accurate and up-to-date.

Cost Accountants

Cost accountants analyze and track the costs associated with producing goods or services, and they use this information to help organizations make decisions about pricing, production, and other financial matters. They work closely with other departments, such as production and sales, to gather data on costs, and they use this data to create cost models and cost analyses. Cost accountants provide valuable insights into the financial performance of an organization, and they play an important role in improving efficiency and reducing costs.

Forensic Accountants

Forensic accountants use their financial and investigative skills to uncover financial fraud and other financial crimes. They work closely with law enforcement and other organizations to collect and analyze financial data and provide evidence for legal proceedings. Forensic accountants must have a strong understanding of financial systems and processes, and they must be able to detect and analyze financial irregularities and patterns of fraud. They play an important role in ensuring the integrity and security of financial systems, and they help to prevent and detect financial crime.

What we Say

The field of accountancy offers a wide range of job opportunities, each with its own unique set of skills and challenges. Whether you're interested in financial analysis, tax preparation, or uncovering financial fraud, there's sure to be an accountancy job role that's right for you.

Our courses are flexible and convenient: We understand that busy schedules can make it difficult to attend traditional classes, which is why we offer flexible course options to fit every schedule. Whether you prefer online or in-person classes, we have a course that will work for you.